Ethereum: "Internet of Blockchains"

Layer 2, Bridges, Oracles and Lotteries Where You Don't Lose Money

After some time away due to unexpected family health issues, we’re back.

What a week of readings, podcasts and learnings. I’m finally starting to understand why so many people call Ethereum the “Internet of blockchains.”

As a rough example, imagine I was willing to pay a lot of money to “use the Internet” to get this post to you as fast as possible, passing other things “on the Internet” in the process (like other people’s YouTube videos, driving directions, etc). They’d probably still get them, just not as fast.

Ethereum allows you to pay more (in “gas fees”) to get things done -- often either A. ensuring it gets done and/or B. more quickly than whatever other people need to get done. Without going too far into Internet infrastructure, YouTube has a bunch of servers to make sure you always get your videos. Same with Instagram, Amazon, TikTok, Twitter, etc. All of these, together with some cables under oceans, are connected and that makes up “the Internet.”

Ethereum has similar servers (called nodes, miners or validators), but they’re trying to do that for everyone, all at the same time. This means traffic jams and bidding wars when you try to use Ethereum’s version of the Internet for blockchains. For tech nerds -- yes, there’s overlap between the two, and no we’re not getting into that.

To foreshadow what I’ll likely write about over the next few weeks; layer two eases those traffic jams and bidding wars. I finally used Zapper (as a bridge) and Polygon (layer 2 scaling) to transact for pennies as opposed to $20+. There are several alternatives to both out there that I’ll be trying over the coming weeks and months, but this is a much more sustainable future. Ethereum is trying to bake these into itself with some upcoming changes over the next 6 months.

I’m pressing on with the cliffnotes experiment, leaving links + my notes from the more interesting things I’ve encountered over the last week. As always, let me know if there’s something I should add to my list!

Louis

——————————

Not Boring -- Own the Internet (Ethereum)

Ethereum is like Excel, specifically in both tracking data as well as linking together of functions and their outputs

ETH is seeing more transaction volume, supply is about to start deflating. For armchair investors, you can almost think about it as the current web3-wide ETF

Bitcoin also uses Proof of Work, that’s where Ethereum got it from, although Bitcoin mining is able to be run on cheaper hardware and has 20x more miners than Ethereum, and is therefore more decentralized.

Miners make close to 0 (2 ETH and transaction fees/gas), chip makers and utilities collecting most

EIP 1559 -- make things deflationary. Gas becomes base fee (which is burned) and then a tip to get better positioning

Eth2 brings in scalability via PoS and sharding

Additionally, third-party Layer 2 solutions, like Polygon and Optimism, are already working to speed up transactions and lower fees by essentially batching transactions off-chain and settling on-chain in one transaction instead of many (there are intricacies, but this is close enough)

L2 solutions could increase throughput another 100x, and combining Eth2 and L2 solutions could lead to a 10,000x improvement if the theory plays out in practice.

Lindy effect, but more specifically belief in legitimacy are the most important things to crypto. Vitalik and others agree

Projects that build on top of certain blockchains are actually financially incentivized to support the value of the underlying blockchain in order to secure their project

Flow & Solana are the layer 1’s that are most interesting and relevant, but not necessarily competitive to Ethereum

SOL is directly competitive with NYSE. Execution layer for finance

50,000 TPS for $.0001 vs 19 TPS for ETH

Rollups are layer 2 solutions -- they “roll up” a bunch of transactions, then appear as one transaction on layer 1

Speed takes fractions of a second vs 13 seconds or many minutes, depending on gas fees

Gas fees for Uniswap transactions are ~$1 vs $19 on mainnet

MIT Blockchain & Money: Lecture 6. Smart Contracts & DApps

Joe Lubin invested in “Ethereum” for 9.5%, Ethereum foundation had 9.5%, 80% sold via ICO for $18M

Unclear whether NEO was launched (originally as AntShares in 2014) with backing from Chinese government. Given ongoing existence, speculation is that there’s strong cooperation

$28B of ICO volume (as of Aug 2018) with EOS at $4B and Telegram at $1B

59% “fail” in the first 9 months (disappear, cease to exist, etc). 25% appear to be fraud

Larry Lessig guest lecturer

Contract definition: promise or performance given in exchange for promise or performance

Performance for performance is interesting for blockchains; I’ll sing if you pay me $5,000

Vending machine is a great example; dime = can of coke

Lowers transaction cost

Express vs implied (it’s safe to consume whatever you get out of the machine)

When things are “implied” the legal system will police the contracts and enforce + punish

The state is always “present”, but they don’t tend to care about most contracts. Intuitive -> they get involved in the edge cases

Not worth giving up on the deal if there’s a .002% chance something happens (ex ante). Easier to use courts to do it ex post

Spelling all of those out in code/smart contracts could actually raise transaction costs -- the same ones we’re attempting to lower

90-95% of the work lawyers do, doesn’t need to be done by lawyers. It could be cleaned up and factored out

Copyright law; “if you create, then you get”

Exclusive rights, lifetime + 70 years, fair use

DRM (digital rights management) has already/will continue to impact multiple of these

Example of Apple making it hard to rip videos at the operating system level

Point of contract law isn’t to eliminate risk -- it’s to allocate risk

Contract law only works if there’s a system to process the breach (well-functioning legal system)

Developing countries can’t take that legal system for granted

But if blockchains provide that technical infrastructure, it could be a great substitute. Enabling those citizens to interact (in the absence of failed legal system)

Great 5 minute video descriptions of Public Key Cryptography and Digital Signatures

Receiver places their public key out on a server. Sender uses that to encrypt, and it can only be decrypted using sender’s private key

Anybody can send the receiver a message, because their public key is out there. Can’t verify the sender without digital signatures

Bob writes a message, hashes it and encrypts with his private key. The message is still public, but the digest can only be verified by decrypting it with his public key (to prove he signed it). If digest is the same after running through the hash function, it’s clear Bob sent it

Digital signatures are generally popular with email

Started in 2017 as “Matic” by Indian developers working on L2 scaling solutions; Plasma Chains and PoS Ethereum side chain

Raised $5.6M in 2019 via Binance, went live in mid-2020

Took off due to increasing gas fees on Ethereum mainnet

Plasma, Optimistic rollups and ZK rollups are most popular L2 scaling solutions

Sidechains have own security mechanisms via different consensus mechanisms; distributed validators or security as a service

Stand-alone chains are fully sovereign, meaning high flexibility and independence (but harder to secure; need more validators). Preferred by enterprise and startups with strong communities

Secured chains offer most security, but have less flexibility and sovereignty (preferred by startups and security-focused projects)

Polygon supports both and things in the middle of the spectrum as well, with several layers of architecture that allow for scaling abstraction up or down

Plasma can allow for fast and scalable transactions by using side chains, but it takes longer to withdraw funds from layer 2

Matic POS chain runs parallel to Ethereum mainnet, but relies on their checkpoints and validator staking (EVM-compatible)

Risk would be if one of the other scaling solutions gets adopted on their own, but Polygon would likely incorporate that into the ecosystem as well

Ethereum is the hub that connects all the different chains in the Polygon orbit (as opposed to Polkadot, Cosmos, etc)

Rollups work by bundling transactions on the sidechain and generating a hash (also known as SNARK -- Succinct non-interactive argument of knowledge). The proof is sent to the main chain

Current wait times to go from Optimism to Ethereum mainnet can take up to a week

ZK rollups are faster, but not portable to layer 1. Optimistic rollups are slower, but maintain composibility (EVM) via OVM. Optimism is a great example

Bankless: Analysis of PoolTogether and prospects for growth moving forward

Feels like the ability to borrow against your deposits (and then redeposit!) isn’t talked about nearly enough. There could be huge leverage plays

Current amounts deposited/borrowed against on Rari Capital

MIT Blockchain & Money: Lecture 7. Technical Challenges

Global payments industry is $1.5T, which is .5-1% of global economy

Slightly outdated, other sources have better + more current explanations of technical infrastructure

MIT Blockchain & Money: Lecture 8. Public Policy

Sometimes incumbents want regulations because it builds barriers for potential new competitors

No government wants to shrink their tax base. Some governments want to attract tax revenue from competing countries (hence more lax structures)

Public policy objectives include financial stability (including currencies) and investor protections

Countries ask themselves “are we going to isolate it, regulate it, or integrate it?”

Central Bank of China has a lab working on blockchain projects, and that’s just what’s public (mining pools and other companies that participate)

Worldwide debt markets are $250T (1,000x size of crypto in 2018), equity is $90T, gold was $7T

Countries will want to regulate and provide consumer protection as ICOs continue to explode

US government decided bitcoin was property (as opposed to currency) -- so you need to record cost basis each time you transact

No regulations on exchanges for things like front-running

Layer investor protection (when one party knows more about the investment) atop consumer protection. Gensler’s list of investor protections

Investors get full and fair disclosure

Fraud and deceptive sales practices are prohibited

Secondary markets promoted with price transparency & anti-manipulation

Advisors have fiduciary responsibility or some sort of disclosures

“Investment contracts” and the Howey Test (1946)

Is it an investment in money (BTC or ETH count)

Is it an investment in common enterprise (developers working on a project)

Reasonable expectation of profits or growth?

Reliant on the efforts of others?

Previous SEC chair thinks most ICOs are securities (from Gensler’s 2018 Congressional testimony)

April 26, 2018, Chair Clayton divided crypto-assets into two areas, those which represent “a pure medium of exchange” and “tokens, which are used to finance projects.” He said that a “pure medium of exchange … as a replacement for currency” such as Bitcoin would not be regulated as a security.

Public policy is formulated by messaging > politics (coalition building) > analysis = policy

MAGA, Change We Believe In, The Compassionate Conservative, It’s The Economy Stupid = last 4 presidential slogans. Messaging

Zapper + Polygon experimentation

Stupidity alert: I spent over $100 before realizing I was being charged for failed transactions on Ethereum mainnet

Connected with Zapper and loved several things

Visualizations and ability to see across platforms, wallets, yield sources, etc. Like all the instruments in a cockpit

Bridges > moved money over to Polygon (fka Matic). Paid the Ethereum gas fees once to “get onto” layer 2 for certain tokens and will pay again to eventually bring funds off. Fascinating what’s going on under the hood with locking things in smart contracts, etc

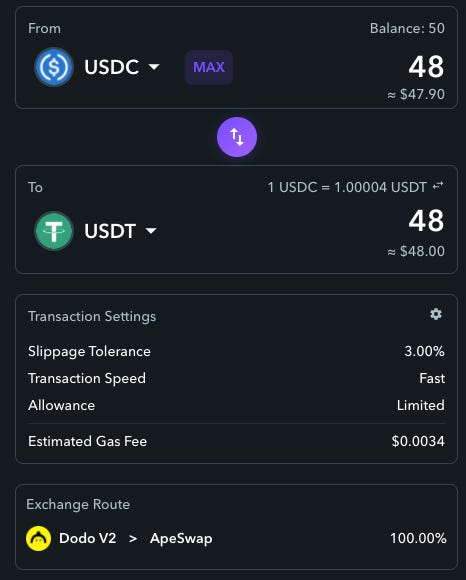

Exchanged USDC into USDT using Zapper (via Polygon [via “Dodo V2 > Ape Swap”])

Deposited USDT into PoolTogether’s USDT Polygon prize pool

Gas fees of $.003 beat $33 gas fees by 10,000x

BlockFi has 700 employees in Jersey City and is regulated, so not DeFi or TradFi. CeFi for “Centralized Finance”, similar to Coinbase

Stablecoin simple definition: “tokenized dollars” (in theory 1 USDC, USDT, etc. = $1)

BlockFi makes money by lending to hedge funds to conduct futures trades, while banks aren’t willing to (yet)

If HFs are making 40%, they can pay BlockFi 15%, who can pay stablecoin depositors 8.6% (which has come down to 4-7.5% recently)

In short; juicy fees and arb opportunities mean others will come for it and eat away at the margins. In the meantime, they’re trying to diversify services like SoFi’s playbook (student loans -> credit cards, insurance, crypto investing, auto loans, etc.)

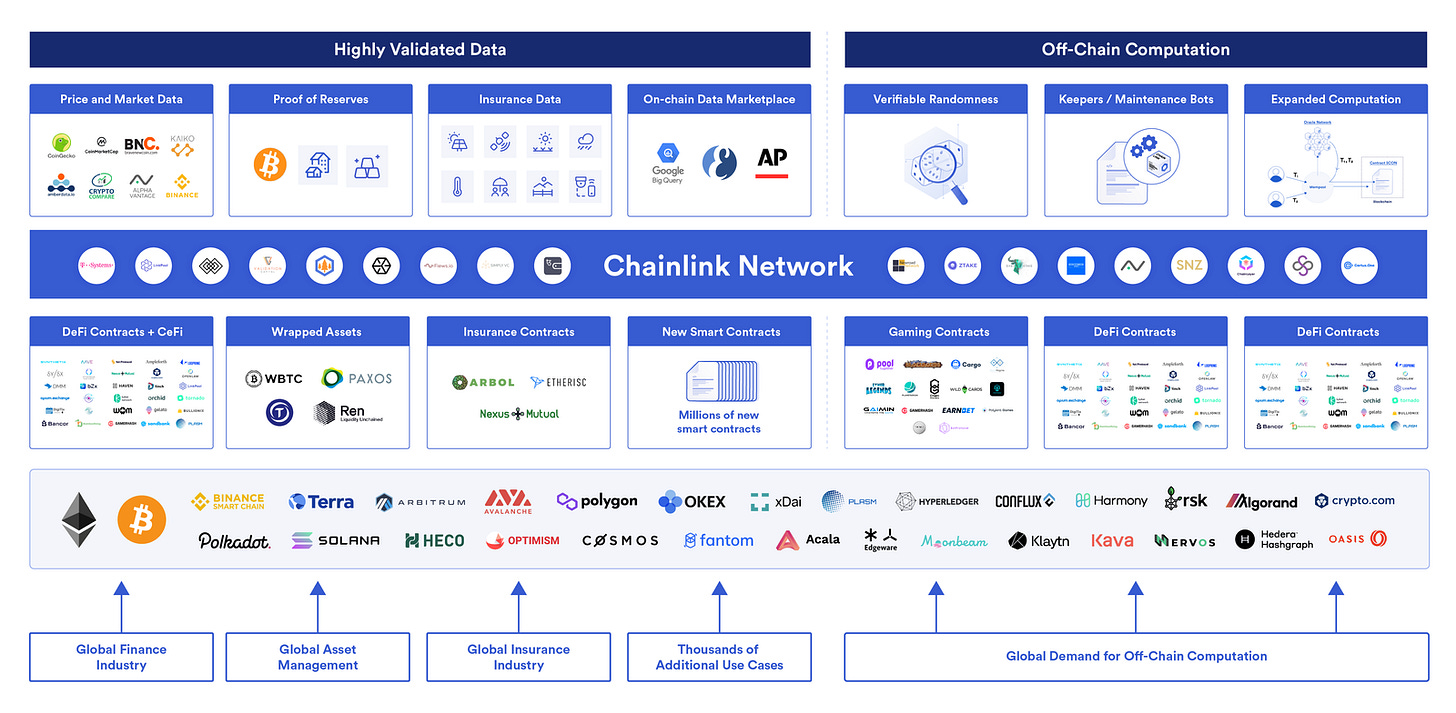

Bankless: Decentralized Oracle Networks (DONs)

Having blockchains disconnected from the real world and data sources (oracles) would make some smart contracts pointless

Having a single oracle or single data source is no good = single point of failure and/or corrupt data

Chainlink handles many of the different moving pieces, as well as off chain computation like randomness functions

Several use cases

DeFi & price feeds -- Price Feeds to calculate the maximum loan size during the creation of a position as well as determine when positions become under-collateralized and must be liquidated, keeping the market as a whole solvent.

Synthetics -- enables users to generate synthetic assets that are overcollateralized by on-chain crypto (SNX) and mirror the price of real world assets such as cryptocurrencies (e.g. BTC, ETH, LINK), fiat currencies (e.g. USD, EUR, JPY), commodities (e.g. gold, silver, oil), indices (e.g. FTSE, N225, sDEFI), and equities (e.g. TSLA, GOOG, AMZN). Backed by a global debt pool, users can “exchange” their synthetic assets at zero slippage for any other synthetic by simply switching the data feed that determines the value of their tokens.

Dynamic NFTs -- introduce “verifiable randomness” to create new functionality, attributes, etc in games or artwork

On-chain audit trails and proof of reserve -- check off-chain data to see if loans are undercollateralized

Already being used with TUSD, PAX USD stablecoins, as well as cross-chain with WBTC from Bitcoin. Verified by auditing firms

Tokenized real estate will also provide proof of ownership, rental income, etc

Off-chain computation & keepers -- perform actions passively (i.e. liquidating undercollateralized contracts, rebasing positions, yield harvesting) vs waiting for humans to proactively take action; which is the current default state

Bankless: Chainlink 2.0 with Chainlink God

Once coins are more liquid and trade more, looking at a specific price at an exchange (especially if time-weighted) it becomes less accurate and secure

Decentralization is required so there aren’t single sources of truth(/single points of failure)

Getting quotes from NASDAQ or NYSE doesn’t move toward trustless, it’s trusting a specific traditional party

Nodes are being paid in $LINK tokens, aligned incentives for honesty

In the future exchanges are going to publish price feeds through Chainlink, selling data to smart contracts

Coinbase delivers this today through a signed API, not as an oracle

Existing users; Aave, Synthetix, DyDx, NFT platforms -> paying some portion in LINK

30 users of ETH/USD price feed, pooling their costs together and splitting them as a group -- each user only paying a small part = Chainlink is most cost-effective option

Each price feed is a contract that needs to be pre-funded by LINK, in order to pay the nodes for updates to feed

Protocols need to acquire LINK to pay for things like running VRF

What stops people just viewing data that’s published on-chain? Lots of free-riding potential, but incentives for huge contract values mean users pay for guarantees that feed will exceed

ZKP is the long-term approach to solve the problem, you don’t reveal the actual price or data point -- computation is done with whatever the answer

Chainlink Labs helps get projects up and running with the protocol + coordinate with nodes

Costs to nodes

running servers (not a ton because it’s not Proof of Work), API subscription (yearly or call), gas costs for Ethereum to get data on-chain

Ethereum can run a node on a consumer laptop. Chainlink has several chains and could hold a ledger for a week. Depends on what sort of DON you want to set up

Multiple tiers of nodes, first tier stakes $LINK while second tier (backstop nodes) has ability to resolve disputes and slash first tier’s stake. Financial incentive alignment as second tier is heavily exposed to $LINK

Can also use ZKPs to prove that original dispute was one way or the other

Nodes that lock up more $LINK are most trustworthy, similar to PoS with ETH 2.0. It’s the right to generate revenue in the network

DONs can do off-chain computation and then interact with other DONs, avoiding costly need for on-chain computation. Usually on-chain activity should focus on settlement

LINK community is incredibly passionate. Personified as “green frogs” all over Twitter

Don’t save “why” for last at the end of who, what, when, where, why. Start with it

Ensures you’re asking the right questions, have the right motivations and aren’t bringing too much baggage

Great link to Richard Feynman on asking why and how there are so many assumptions embedded in questions. You need a lot of tooling to really get to an answer (and you might never get there)

Never lose the motivation to continue exploring. There’s a time and a place, but many of the best discoveries were happy accidents at the end of rabbit holes

Random stuff

Interesting crypto market size tracking: Overall market cap of USDC

The new BED index seems to be worth watching; ⅓ BTC, ⅓ ETH, ⅓ DeFi index. Roughly what I recommend to people, and you can even LP your ownership of it. Hmm