[Whitepaper Summary #1] Bitcoin & Billionaire-Making

Will the majority of Earth's billionaires come from crypto?

No-way-that’s-true stat

Coinbase recently projected that a Bitcoin price of $200,000 would mean half the world’s billionaires made their fortune via crypto.

Forbes listed 12 billionaires in their 2021 list. But according to lists of the top bitcoin wallets, there are:

32 wallets holding >$1 billion worth of BTC (based on $42,000 price in May 2021)

7,500 have >$10 million

86,000 with >$1 million

Some of these wallets belong to exchanges that house funds for numerous clients, but there are also massive holders that have their holdings spread across numerous wallets (return of the Winklevii, Gemini strikes back).

Think about what ideas, projects, causes, etc. would get funded by this new wave of wealth. Space, human longevity, nuclear fusion, ... what else?

Whitepaper Summary #1 — Bitcoin

Where else was this journey really going to start, KodakCoin? Coinye? Cumrocket?

The Bitcoin Whitepaper is 9 pages long. ~3 of which are references, math proofs or probability tables. But you’re busy and I <3 job security.

1.7 million results for [bitcoin whitepaper explained] means there aren’t a ton of hidden gems. Worry not, we’ll make up for it with humor, metaphors and nerdy stats.

Abstract

The very first sentence reads;

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

“Pay each other without middlemen” because there are so many middlemen in a transaction between me <> you or you <> business. The second point is that the “double-spending” problem hasn’t been solved (with cryptocurrencies) before.

Satoshi’s answer combines “digital signatures” and “hashed-based” proof of work, hinting at the most important part — every transaction is out in public.

What Problem Does it Solve?

In short; what if we can’t trust the banks and financial plumbers anymore?

If you send me one of your Bitcoin, you no longer have that specific coin. Subtle but critical concept that seems the same as you Venmoing me a $1 bill.

In general, neither you nor I care which of the green pieces of paper with a $1 in the corner get handed over. We can’t see the list of all the serial numbered bills in our bank accounts, for a bunch of reasons. (aside: Where’s George is so nerdily cool for tracking where bills have been)

Historically, that’s been ok because we Americans have a bunch(?) of trust in Chase, Visa, Venmo, Bank of America and all the groups in between that keep track of how many dollar bills we each have.

To do this without one of those “trusted” third parties, Satoshi proposes publicly announcing all of the transactions. The participants and nodes/miners collectively agree that the payee was the first (and only) one to receive the coin.

Voila, now you can do all the same transactions you would’ve done but you’re not going to get frozen out of your money by a bank, government or anybody else.

Bring $75 million across international borders by jotting down a few random letters and numbers on a piece of paper. Or memorize them. Way easier than carrying suitcases of cash or 100 gold bars1.

Finite Supply of Coins

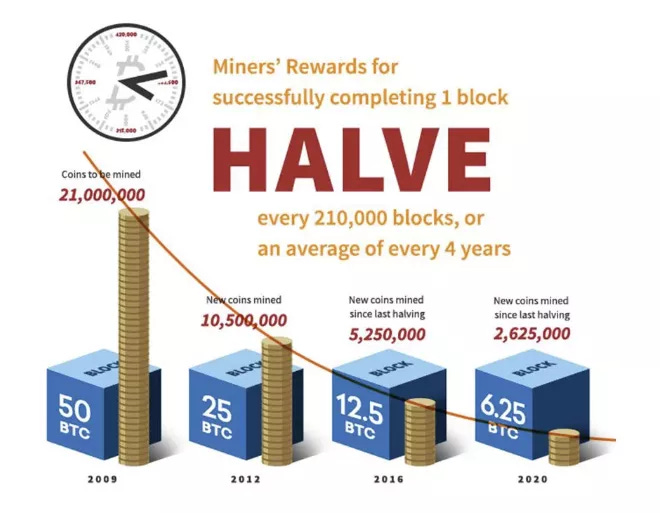

There will only ever be 21 million coins. The last of which should be mined on May 7, 2140. Don’t lose sleep for your great great grandchildren though. If they become miners, they’ll collect fees instead of block rewards.

“But haven’t 18 million coins already been mined since 2009?" How will we only get 3 million more over the next 120 years?”

Investopedia has a better graphics team than me.

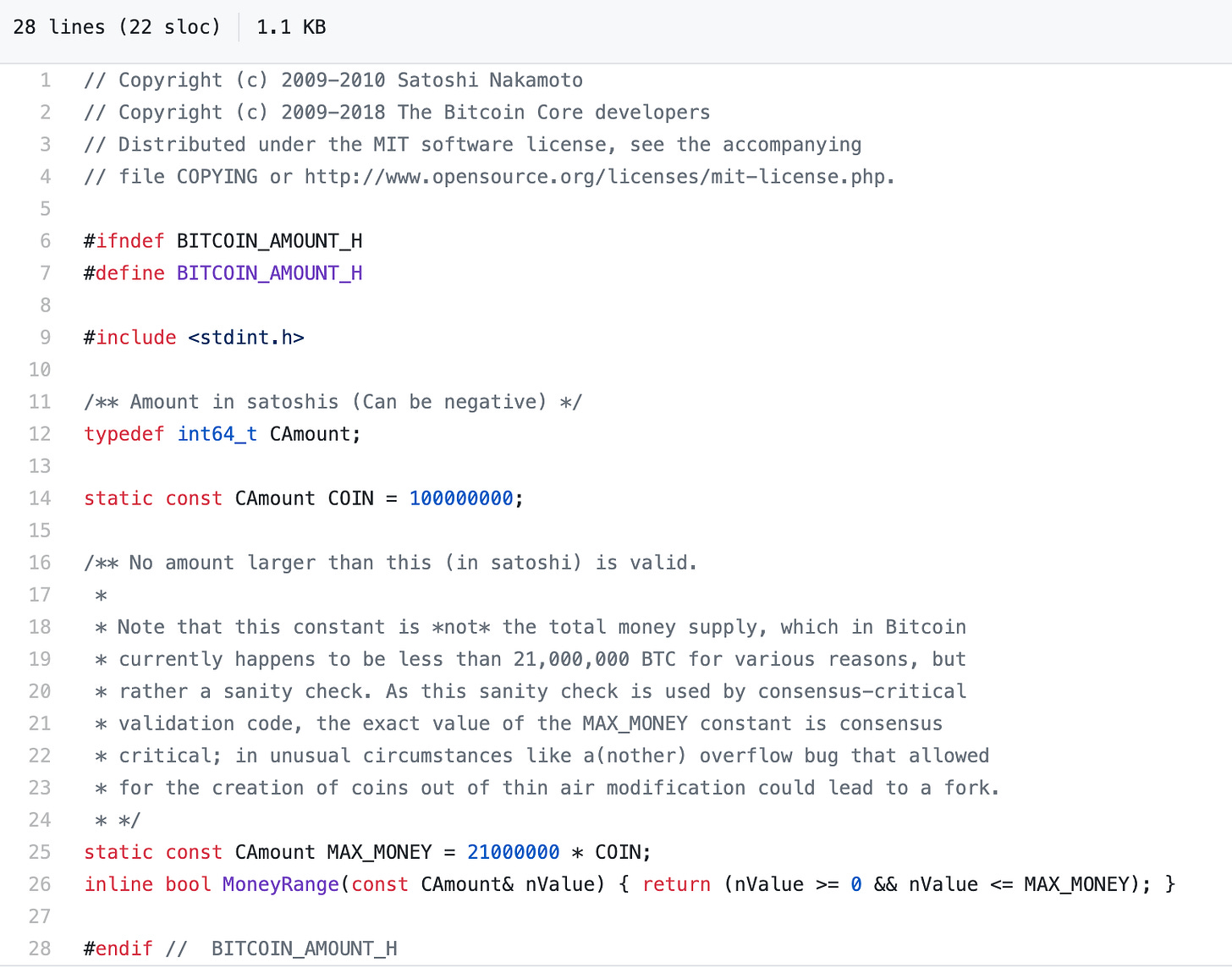

Also, each Bitcoin can be subdivided into 100,000,000 “Satoshis” aka “Sats”, similar to 100 pennies = 1 US Dollar. Interestingly, Satoshi’s source code references these Sats as the base unit, instead of entire coins (line 14 below). He presumed people way off in the future wouldn’t be tossing around entire coins all that often.

Unless you’re buying $500 million worth of pizza for 10,000 BTC.

51% Attack & Incentive Alignment

If 51% of “nodes” (he didn’t realize/reference “miners” becoming a thing) conspire against the rest, there could be trouble. But — there’s an insurance policy!

If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

Blocks Rely on Previous Blocks

A common misconception is that miners are mining into the blockchain to break out a block and collect the rewards. But more accurately they are mining a block with hopes of adding it onto the blockchain (digression; “assembling” is a more accurate visual, even though it’s an antonym for “mining”).

In other words, 1. construct a block 2. polish it 3. hang it on the one and only hook from the previous block. All before any other miner can hang their finished block on that same hook.

If anything is changed in any block, the hash (i.e. digital fingerprint) changes and all subsequent blocks in the chain are broken. Proof of work means each link between blocks is hard to generate, so you need to “prove you’ve done the work” to create it.

The only way to mine the block is by finding the right “nonce” + timestamp + transaction combo -- which takes about 10 minutes, regardless of how much computing power is on the network.2

Based on cryptographic proofs (i.e. more complicated math than most people ever want to learn), it’s incredibly hard to go back and change previous transactions. So you’d have to get the longest chain + go back and rewrite history.

Privacy in Public

Understanding how the network operates is fairly straightforward. Every node has a copy of all the transactions since the Genesis block in 2008.

New, unverified transactions are continuously broadcast to all nodes (stored in the memory pool or “Mempool” if you want to speak crypto).

Miners check which chain is the longest (i.e. has the most blocks).

They take the last block’s hash, compile transactions from the Mempool into a new block and start guessing numbers (remember; nonce <> timestamp <> transactions = find a hash below a certain limit)3

If you find your proof-of-work, tell all the other nodes and they’ll quickly verify it. Miners don’t want to waste time when there’s no incentivize left on the block they’re on.

Nodes check to make sure there’s no funny business (invalid transactions) in the block.

See step 1.

Math

The end of the paper highlights a couple fancy looking calculations that essentially boil down to how likely it is for Charlie Brown is to get Lucy’d out of their coins.

It gets exponentially harder after even a few blocks have been mined. Unless you control a ton of the computing power and get lucky to re-mine the blocks before the honest nodes/miners. In which case (as mentioned before), you probably could have just earned rewards and fees without undermining the network that you’ve invested so heavily in.

Makes You Think

That last paragraph leaves open an interesting area. If there are actors that A. have a ton of compute B. don’t care for/disdain the legitimacy of Bitcoin and/or C. want to undo some recent previous transactions, how safe is the network?

There are some countries + companies that come to mind, but this author isn’t nearly qualified enough to dive into that geopolitical mess.

Obviously I did the math. Your standard gold bar is 400 Troy ounces (~28 pounds). 400 oz x $1,887/oz price in May 2021 = ~$750,000. 100 bars = $75 million. Cool visual, right?

Now that ASICs are here as opposed to the CPU on your laptop in 2008, the nonce is a lot harder to find. Technically, that means there are a lot more 0s at the start of the hash. And to “unlock” a hash below that value, you need to guess a bunch of times. Like, quadrillions of times.

If you want to know more technical specifics on how mining works and some methods the big players use to mine, I highly recommend this 10 minute read.